This is a follow up, an interlude if you will, to part one of the three-part whitepaper series about the future of energy and the role of Oil and Natural Gas in that future. Part two is in the works and will be out soon.

In the meantime, I want to share with you some of my journey exploring the oil and gas space as an investment potential and how I look at its risks and rewards. I also want to tell you why I ended up working with King Operating. This is not a research paper per se (although I expect to write more than a dozen of those this year). Rather, it’s intended to give you some insight and hopefully some comfort in my process.

Let’s Start with ESG

Over the last 4-5 years the environmental, social, and governance (ESG) movement has been increasingly aggressive about getting large pensions, fund managers, endowments, insurance companies, and banks not just to abstain from investing in new drilling but to get rid of all their public oil equities. This has not only reduced the amount of drilling in the US (and other parts of the world) but has lowered the price of energy companies in terms of their P/E ratios, book values, etc. As I outlined in my first white paper, oil and gas company stock prices aren’t adequately reflecting the value of drilling for new production. Instead of increasing drilling operations, most are essentially only replacing their current production.

This has the perverse effect of increasing rewards for participating in the risk of drilling for oil and gas. Over 2/3rds of current US drilling is by private funds and companies. Without the artificial influence of ESG policies, this advantage would be arbitraged away. The breadth of this opportunity would not be available in normal market conditions, yet it exists.

You should have already read the first of my series of papers on the future of energy (if not you can get it here.) I explained why I think that the demand for oil is going to rise faster than supply over the medium and long term, despite magical thinking on the part of those who believe we can will ourselves into a new alternative energy world. Fortunately, this is great for oil investors as it suggests we will see higher oil and gas prices due to supply shortfalls.

I have become increasingly convinced that the “woke” ESG movement is presenting us with a unique opportunity. The question is how to capitalize on it.

You can of course invest in public oil and gas companies, but the mechanism is such that the public companies basically absorb the upside in their price. Not that a rising oil price will be anything but good for oil companies – it just doesn’t have the upside multiple that directly investing in drilling the King way does.

The Upside in Oil and Gas Investing

I started my search both online and personally working my network trying to find something beyond the traditional oil private offering, which was drilling two to three wells and hoping you hit oil and the associated working interest income. After 40 years of living in Dallas, which is one of the epicenters of oil and gas business development, I have seen real success alongside of failures. Oil and gas working interest income is nice, and you certainly want it, but for me it simply doesn’t represent a compelling risk to reward scenario.

Continuing my quest for a better way to exploit the coming “woke” energy shortages, I called my friend Jay Young at King Operating (whom I have known for almost two decades). At the time I called, I assumed Jay was still in the traditional oil and gas drilling private offering business. But he’s extremely well connected, so I was actually hoping that he could point me in the direction of something different and better.

It turns out that Jay had significantly transformed his business model. He was still drilling, but with a few significant twists. First, he was doing much larger projects in multiple fields, working to “prove up” the value of those fields. Secondly and most importantly, he was allowing “smaller” investors to participate in the any achieved increase in value of the fields he was drilling. Large institutions and private equity funds were doing this, but to the tune of several hundred million per program. That is a big bite for most small oil operating companies.

Essentially, Jay had completely changed his model after a talk with a large real estate multifamily apartment developer. He actually wrote a book describing his new model called “The Upside of Oil and Gas and Investing.” (You can get it on Amazon.)

Briefly, this is how the apartment real estate model applies to oil and gas development. Think of buying an older Class C apartment complex in a good neighborhood, using leverage and investment to upgrade the apartments to Class A with appropriately higher rents. When you have established the new value after a few years, you sell or “flip” the property to a long-term operator. Properly done, your cash on cash return is a multiple of your actual at-risk capital.

What King does is buy an underdeveloped but geologically compelling field to work it through drilling in an effort to drive up the total valuation. Typically, these fields were drilled 20+ years ago using vertical wells and little to no fracking. In its season, the field was productive but never fully developed. By drilling and exposing what industry insiders call proven and probable reserves, the known value of the field effectively becomes greater. Investor partners directly participate in this increase in the value of the field.

Let me offer an example of what I mean (not based on any particular real-world field but hypothetical which is fine for our purposes here).

Start with a 20+ year-old field that was originally drilled using just vertical wells. Many were not even fracked, but we know the oil is there. Utilizing 3D seismic imaging, geologists have a pretty good idea of where and how much oil or gas is potentially in this field, though I should point out that even with all the technology we have today, there will be surprises both good and bad when you actually drill, as we will see below. But the technology and proven location does mitigate risk of dry holes.

Once you have acquired the field and raised the money to develop it, you begin a drilling program. In most fields (but not all) that means horizontal (and some vertical) fracking. What you essentially do is allow the geologist to tell you where to drill. Typically, though, the well is near 2 already proven older wells. It is not quite like shooting fish in a barrel, but your odds are significantly better than drilling in an unproven “wildcat” field. You have to actually drill to find out how much. (See risks below because there are other factors besides just finding oil.)

The price to acquire a field is based on a number of market factors including the obtainable data about reserves and historical production from legacy wells. When King buys an old field, the proven reserves are a fraction of what they were when the field was new, as the oil in the small vicinity of their vertical well has already been extracted (normal depletion).

Think of it like a stack of pancakes. The best pancake stack is one where the cakes are saturated in syrup. If you stick a straw in that stack, you can get the syrup/oil from whatever zone the end of the straw is in. But if you go down to a cake and then horizontally drill for a few miles and then frack, the potential for increased production is exponentially more. Further, you remove the need to drill multiple vertical wells over that two mile zone, focusing the use of capital on returning quantity and value at scale.

In a moment, I will tell you of a remarkably good outcome from the current drilling in King’s Program 4 as well as an unexpected geological formation. It is a perfect illustration of having to drill in order to actually find out what’s down there.

Looking Deeper

During the time of my original investigation into King, I started looking for other companies that were doing something similar for retail investors. Surprisingly to me, I did not find one. It just seemed obvious. And while you can never know what is really going on in the head of an operator, I suspect what was happening (and this is a suspicion, not a fact) is an oil promoter would get a field, raise the money to develop it, give the investors the working interest on the oil and gas produced in that field, but would keep the profits from flipping that field to themselves. In essence, they used client money to improve the value of the field that they owned. Is that every case or can I prove it? Not really, but the facts are what the facts are. Oil operators simply were not in the habit of sharing the value of the field with retail investors.

I should note that there is now at least one other company doing something similar to the model that King is using (although smaller and only one field), and I suspect by this time next year there will be multiple companies emulating King’s clearly superior business model. Frankly, this model is also easier to sell because it makes more sense for the investors. The fact that more aren’t already following this lead is a little surprising but it’s just not what normal oil operators have been doing for the last 50 years. Jay clearly had to think “outside the box.”

Here is where I had a little luck. I called my compliance consultant, a fixture in the compliance community in Texas for the last 30 years. She basically told me that I could not do any oil deal until I had had it blessed by a particular attorney, who was semi-retired but still knew everyone and everything about the oil development business.

His name was familiar to me, and I’ve finally realized he was the partner of a law firm that I had used in the early parts of this century until the senior partner that I worked with retired. The attorney she wanted me to talk with was his primary partner. I called him and we caught up and I asked him about Jay Young and King Operating. It turns out that he had been working with Jay and his team at King Operating for well over 2 decades, although since he is semi-retired he was no longer engaged, so he was free to talk to me.

He was very positive about King and their operations and gave me a lot of information about not only the company but about the individuals involved, things that I could not have figured out on my own no matter how deep I tried to go. Like I said, sometimes it is better to be lucky than good.

Further, I literally grew up in an oil patch in Wise County, Texas where the predecessor to Mitchell energy was drilling for gas. My best friend from first grade ended up becoming a senior executive eventually running public oil companies quite successfully. We have stayed in touch all these years. He agreed to meet with Jay to give me an idea of the actual feasibility of what they were doing. Bottom line? While he could not comment on King as he had no familiarity with them, he did think that the business concept was sound.

Armed with this information, I was able to do a much more focused deeper dive into the project. The more I learned and talked with the team, the more I liked what I saw. I decided to move forward and joined King Operating as their Chief Economist and became a (not insignificant, at least to me) partner in their new and current fund called KOPX Program 4. It is a multi-field program (that means we are drilling in more than one field). By the time you read this, we may have three operating wells with a plan that could reach 18 new wells this year if things continue to go well.

You can review the slide deck and should talk in-depth with your questions to a Senior Vice-President, who knows the program well and can get you the answers you need.

Full disclosure: I’m being paid as a consultant by King. I also will benefit to the extent the project is successful as a General Partner. I have restructured my business model to give me the time to devote to this project. I am “all in.”

The Risks and Rewards of Oil and Gas Investing

First, there are real risks involved in any investment private partnership and oil and gas partnerships have their own peculiar risks. You should read the private placement memorandum especially focusing at a minimum on the risk section. You should talk with your accountants and other advisers and get their advice. Some, but not all, of the risk are on the pages at the end of this document.

Now let’s talk about what I think the risks are of this particular program that I want to call your attention to. This is not meant to be a comprehensive look at the risks by any means. Because of the nature of what I’m describing, it makes sense to talk about the rewards at the same time.

First, the price of oil and gas is a key risk factor. Right now, the Program is focusing on oil drilling as the price of natural gas is somewhat depressed. We will be producing significant gas production as ancillary to drilling for oil associated with natural gas, somewhat typical in the Permian.

I mentioned that the plan could deliver up to 18 wells this year. Hypothetically, we could hit 100% of the planned wells, and if the price of oil drops below $40, the value of the field, which is what we are focusing on, as well as the working interest income from the production, will simply not produce the returns we have projected assuming $80 oil. The incentive to sell the field at $40 would be significantly lowered (except for companies that want to buy an asset cheaply) and would likely push out the time frame in which we were able to close out the fund and deliver the multiple on invested capital we eventually hope for. That of course will clearly reduce the annual rate of return over the time of the investment.

The flip side of this is that, as some analysts predict, oil could go to triple digits. Even if we are somewhat less successful in the actual drilling, the value of the field will potentially be more than we are currently projecting. And while you can tell from the paper I have recently written that I am optimistic about the price of oil, in the short term there are numerous things that could drive the price of oil down, not the least of which would be reduced demand due to a global recession. We saw what happened in 2020. Now, the price of oil did recover but it was certainly not immediate.

While the rest of the world is struggling to replace the roughly 5 to 7% new drilling a year needed to maintain current production, history tells us that is not always the case. OPEC is currently trying to maintain or increase the price of oil by reducing production, but they have done that and been unsuccessful in the past. This is clearly one of those cases where past performance is not indicative of future results.

Will the price of oil and/or natural gas recover in that situation? I believe so, but I’ve been wrong before.

Secondly, there is simply no assurance no matter how much research our geologists do that we will get the production out of the field that we plan. While we are drilling in underdeveloped fields, utilizing massive improvements in technology, we are drilling 5 to 10,000 feet below the surface of the earth and then hoping to go out another two miles from there. You can talk with old oil hands, including those on our team, and none of them will tell you that any well or project is a slam dunk.

Being clear, we certainly expect to find oil where we are drilling. These are known fields and we are not wildcatting. But in one of our first three wells, as we were “turning the corner” we ran into a formation that basically blocked the drill bit from going forward. The well will still be productive but it is not expected to produce at the forecasted level because there is simply less well bore available for capturing oil.

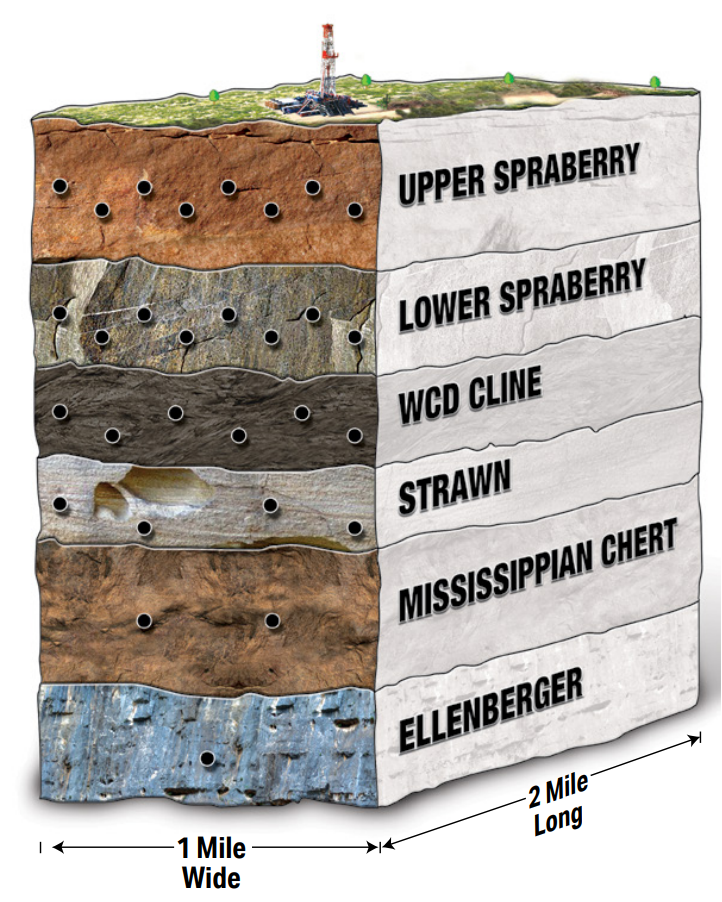

The other two wells are coming in above expectations. This is where technology comes into play. You can actually analyze in real time the “mud” coming up from the well to see what kind of hydrocarbons there are. While we knew there was at least one productive zone (and being in the Permian assumed at least two), we have data that indicates there are six potential pay zones. I should note that we’re drilling in Borden County (insert map and location in the Permian) and the zones we have found appear to be extensions of (for those familiar) other known zones in the Permian. Below is an illustration to give you an idea of what things look like.

Jay tells me there are somewhere near 20 specific zones spread out across the Permian, but not all are productive and some are not repeatable. And not every field or region in the Permian has the same zones or potential. Getting two productive zones in this field would be phenomenal. We would be VERY lucky to get three productive zones from this field. Why not all six? Because even though there are hydrocarbons there, it does not mean they can be economically developed. This is a good problem to have but it means we will likely drill more wells to find out.

I mentioned above that we are planning to drill up to 18 wells this year. We also plan to drill as many wells next year, and the year after that until somebody buys that field.

Just as the real risk of a dry hole or a mechanical failure exists whenever you drill a well, the unexpected also happens and you find six zones. Will these be as productive as the same zones elsewhere in the Permian? Ask us when we drill those zones.

There is a very real potential that we find multiple pay zones just as much as there is to find only one productive zone. Just as in any sport, you have to play the game to find out who the winner is. Sometimes #15 does indeed beat #2. We will have to drill to confirm that the zones we found cover the property and are productive, but it does change (for the potential good) the economics of drilling. If you believe you can drill 40-60 wells over a few years in one field, you plan differently, especially if you can drill multiple wells from a single pad. It is still too early in the game to know, but to talk with the team, you can feel their excitement. It is contagious, so pardon my enthusiasm a little bit.

Another risk is that the zone we currently are pleased with may not extend over the entire acreage. Did we get lucky with those first few wells and the real pay zones go outside of our acreage? While the scans suggest that is not the case, at least to our geologists, (I know I sound like a broken record), but we have to drill to find out.

Another risk is that the field has oil but is not as productive long term. While that is not typical in the Permian, it can certainly happen. Then again, sometimes you get more production and new technology allows for old wells to be “renewed.”

The Program is not liquid. While you will get income from working interest income, the program is illiquid until it isn’t, and we have don’t yet have enough information to say when that will be. Are we already talking with potential buyers? Of course. There are known larger operators in the area who may have an interest. Plus, there are a lot of private equity funds looking to buy into proven operations which could provide partial liquidity. The way the fund is structured, the General Partners are incentivized to see you get a return of your capital as quickly as possible.

Final Thoughts

Let me finish by pointing out a few positive notes. You do get to an opportunity to write off up to 100% of your investment against your taxable adjusted gross income, the bulk of which you can do in the first year and the rest over the following four years. See your accountant and talk with a King SVP to see how that will apply in your situation.

Further, the Program will produce oil and gas working interest income which can be potentially significant. King pays this monthly, and you will get them until the field is sold or as long as it remains commercially viable to deliver income. King calls this MPI (Monthly Passive Income). As a small bonus, the early MPI can be tax sheltered as we write off drilling expenses. The details are too much to cover in this paper but ask the SVP when you talk to them.

King is projecting a total return in excess of 3X for the Program. As noted above, that is partially based on $80 oil. The price of oil can adjust that return up or down. And I have not even mentioned another major field in Wyoming that we have not yet drilled. You can find out more about it by talking to the team.

One last note, a reminder…part two of the three-part whitepaper series about the future of energy and the role of Oil and Natural Gas in that future is coming soon.

What to do now?

Talk with your SVP and ask lots of questions. I hope you decide to join us as we discover the real potential of these fields. Book your Zoom meeting (or phone call if you prefer) HERE.