Learn

The upside strategy

Acquire

OG lease assets are acquired in proven fields across multiple basins located in the central region of the U.S. Assets are under-developed and often in a distressed leaseholder position. This acquisition strategy is critical in mitigating risk historically associated to OG investing.

Develop

Development is all about creating scalable value in 2 ways: optimization and workovers on existing, producing wells, and drilling new horizontal wells. This approach is designed to make valuable returns scalable, more quickly for investors.

Divest

After value is created, often in stages, assets become attractive for larger OG producers to acquire. The assets are positioned for sale as quickly as it makes sense for maximum economic return to investors within context of matching the right buyers. This is how a multiple on exit is designed to be achieved.

U.S. Oil Consumption

Crude Oil (Barrels)

YTD Consumption

4177259869

Today's Consumption

6614416

Consumption Since You Arrived

0

Natural Gas (Cubic Feet)

YTD Consumption

18475137352003

Today's Consumption

29254166666

Consumption Since You Arrived

0

Scale it & sell itTM

KOPX is a branded category of Oil and Natural Gas exploration and production partnerships created for accredited investors to achieve monthly passive income, a multiple on invested capital, and significant tax savings.

Strategy

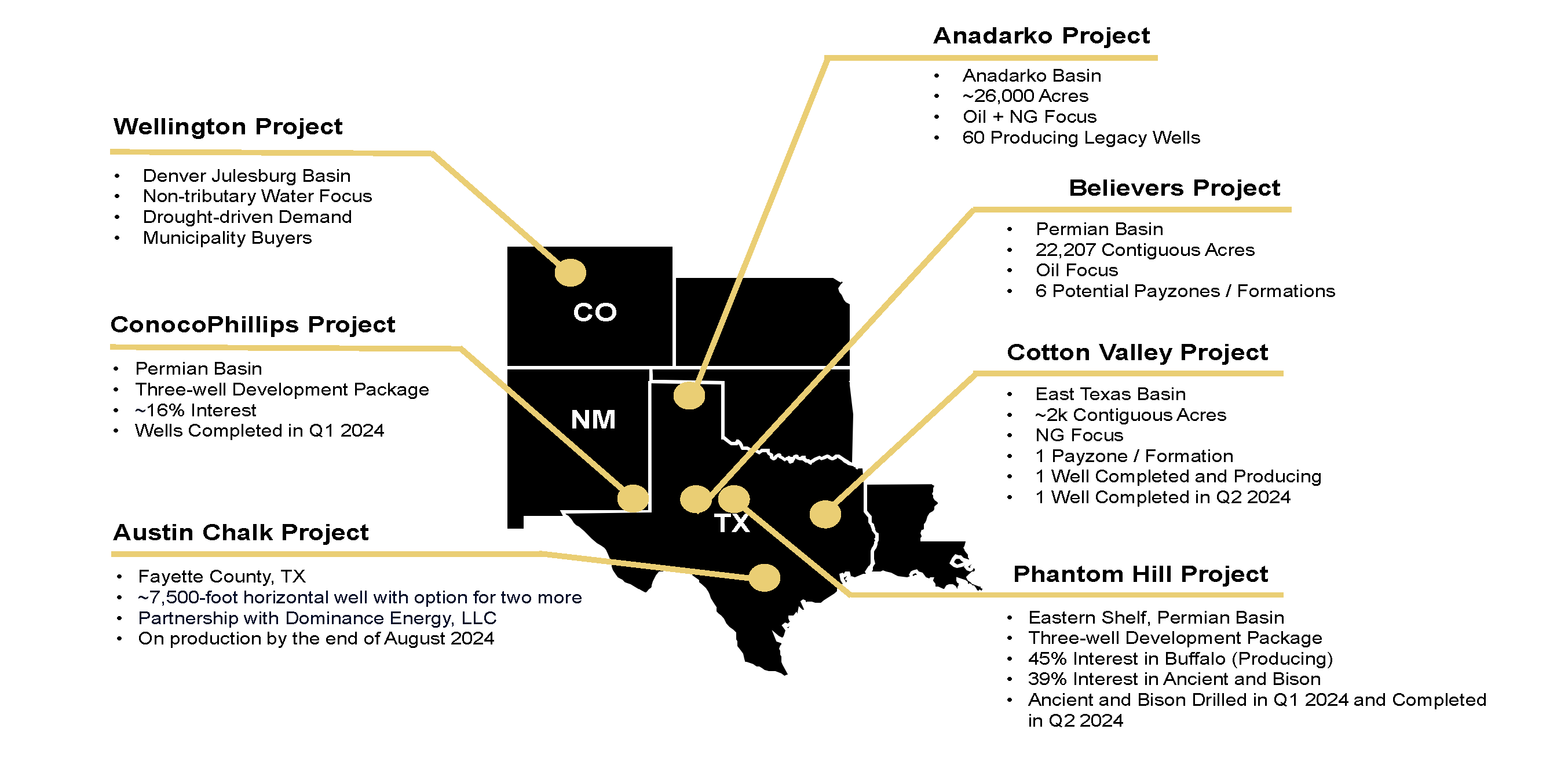

We currently operate multiple Partnership Assets across the United States’ West Central and Mountain regions. Contact us today to find out which investment works best for you!

Partnership assets

Faq

We’ve got answers to all of your Oil & Gas industry questions.

What am I investing in?

You are subscribing to a general partnership that shares in the profits from the production of oil and gas assets. The assets included in our funds are located in Texas and Colorado with a soon-to-be-acquired asset in Wyoming and our team acquires and manages the operations, ongoing production, and sale of these assets on your behalf.

Who can Invest?

Per SEC regulations, only accredited investors may participate in a partnership associated with one of our funds. An accredited investor is someone who has a net worth of over $1 million (not including their primary residence) or has made $200,000 the last two years and expects to make the same this year; or $300,000 if filing jointly.

Do I have to prove that I am an accredited investor?

Yes- you can establish your accreditation by consulting with your accountant or tax professional who can provide you with verification of your status.

How do I earn returns from this investment?

As a general partner, the returns you receive in the form of Monthly Passive Income (MPI) consist of 80% of distributable revenue generated from the production of all working assets associated with the fund you invest in. At the end of the Fund life, we may liquidate the remaining investments and distribute proceeds back to investors, net of expenses and fees.

When can I expect a return?

Newly subscribed partners can expect to receive returns in the form of Monthly Passive Income (MPI) in the month following the completion of their subscription agreement and the wiring of their funds. On the backend, King and its partners require two calendar months to process and distribute funds from production accordingly, meaning that the MPI you receive as an investor in the calendar month of December comes from the profit generated by fund assets in the calendar month of October, and so on.

How long will my money be in this investment fund?

Our Funds have a target life of three to five years. As the fund begins nearing the end of its life, we will begin liquidating the remaining investments and distributing proceeds back to investors, net of expenses and fees.

What is the difference between being a Limited Partner and a General Partner?

King offers the unique opportunity of investing either as a General or Limited Partner. As a General Partner, you can earn deductions against your active income, including regular wages. If you invest as a limited partner, you can only deduct your investment against passive income (i.e. stock dividends or bond interest payments).

Can I invest through a family office, trust, corporate entity, and/or through different financial account types?

Yes, you can invest via multiple entity types and through multiple financial account types, except an IRA. Withdrawing funds from an IRA will likely create a taxable event and will likely eliminate any tax savings opportunities created by becoming a partner with King.

Can international investors invest?

Yes, we accept international investors.

How do I join?

You can get started with your investment today! Reach out to us via our contact page, and a Senior Vice President will contact you directly to discuss how a King Fund fits your portfolio.

What are the tax benefits of investing in Oil and Gas?

In the United States, the tax code is very favorable for investors who take part in Oil and Gas investments. Investors have the potential to write off 75% of their investment in year one and may write off the remaining 25% in 2-7 years for a 100% tax write-off on their investment.

What tax documents will I receive?

Investors will be provided with federal and state Schedule K-1 tax documents.

What is a Schedule K-1?

A Schedule K-1 shows your allotted portion of income, gains/losses, and associated deductions for a chosen investment fund.

When will I receive my tax documents?

We will provide your Schedule K-1 tax information by March 31st following each taxable year.

How long has King Operating Corporation been in business?

King Operating Corporation was founded in 1996 by our CEO, James (Jay) R. Young.

In 2015, Jay restructured the investment model to offer investors lower-risk opportunities that are designed to generate steadily increasing returns in the form of Monthly Passive Income (MPI), a multiple on invested capital, and significant tax savings.

Who is on the leadership team for King?

The King leadership team includes:

Chief Executive Officer, James (Jay) R. Young

Chief Operating Officer, Steve Mullican

Chief Growth Officer, Jimmy Cleveland

Interim Chief Financial Officer, Brian Dutton

Together, the team has decades of combined experience in oil and gas production and managing funds.

Jay is part of four generations in the oil and gas industry. He is the author of the Forbes Books book The Upside of Oil and Gas Investing which details the central mission and model at King. Download a copy here.

How can I contact you if I have questions?

If you are considering making an investment with King and have questions, please fill out this short form and we will get back to you with answers. If you are already an investor, you may also email us at any time at Partners@KingOperating.com.